child tax credit october 2021 schedule

Learn how much you might receive and how to unenroll if you want a bigger refund next year. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5.

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child.

. This can be done by using the IRS portal here. Part of the american rescue plan passed in march the existing tax credit increased from 2000 per child to 3600 per child under the age of 6 with 3000 for children between 6. IR-2021-201 October 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

August 13 September 15 October 15 November 15. Those payments will last through December. You must report the monthly payments received during 2021 so that you can figure out the child tax credit you can claim for the tax season.

The IRS began sending out the fourth of six monthly child tax credit payments on Friday 15 October. 15 opt out by Nov. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

As part of the continuing process of building out the advance CTC program which has included outreach to bring in previous non-filers and the launch of the CTC Update Portal that has allowed millions of. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to. Alberta child and family benefit acfb all payment dates.

With families set to receive 300 for each child under 6 and 250 for each child between 6 and. The first three payments were made on July 15 August 15 and September 15 with the next to come on October 15. Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17.

In january 2022 the irs will send letter 6419 with the total amount of advance child tax credit payments taxpayers received in. The schedule of payments moving forward will be as follows. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child.

Get 100 Compliant with the IRS in a few simple steps. 15 opt out by Nov. Child Tax Credit Payment Schedule 2022Irs started child tax credit ctc portal to get advance payments of 2021 taxes.

As a result of the american rescue act the child tax credit was expanded to. The IRS is relying on bank account. Canada child benefit CCB Includes related provincial and territorial programs.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. The IRS is scheduled to send two more monthly payments in 2021. 15 opt out by Aug.

The IRS is scheduled to send two more monthly payments in 2021. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal. Child tax credit payment schedule 2022irs started child tax credit ctc portal to get advance payments of 2021 taxes.

Payments will be made on the same date in November and December before the other. 2022 Child Tax Credit Payment Schedule. When does the Child Tax Credit arrive in October.

15 opt out by Oct. Six payments of the Child Tax Credit were and are due this year. What is the schedule for 2021.

In january 2022 the irs will send letter 6419 with the total amount of advance child tax credit payments taxpayers received in 2021. Get 100 Compliant with the IRS in a few simple steps. Child Tax Credit Payment Schedule for 2021 Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS.

December 13 2022 Havent received your payment. Recipients can claim up to 1800 per child under six. 29 What happens with the child tax credit payments after December.

The IRS sent October child tax credit payments on Oct. Child tax credit payment schedule 2022. Child Tax Credits if youre responsible for one child or more - how much you get eligibility claim tax credits.

13 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Child Tax Credit Non-Filer Sign-Up Tool.

Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17. This credit begins to phase down to 2000 per child once. When will I receive the monthly Child Tax Credit payment.

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Childctc The Child Tax Credit The White House

2021 Child Tax Credit Advanced Payment Option Tas

September Child Tax Credit Payment How Much Should Your Family Get Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

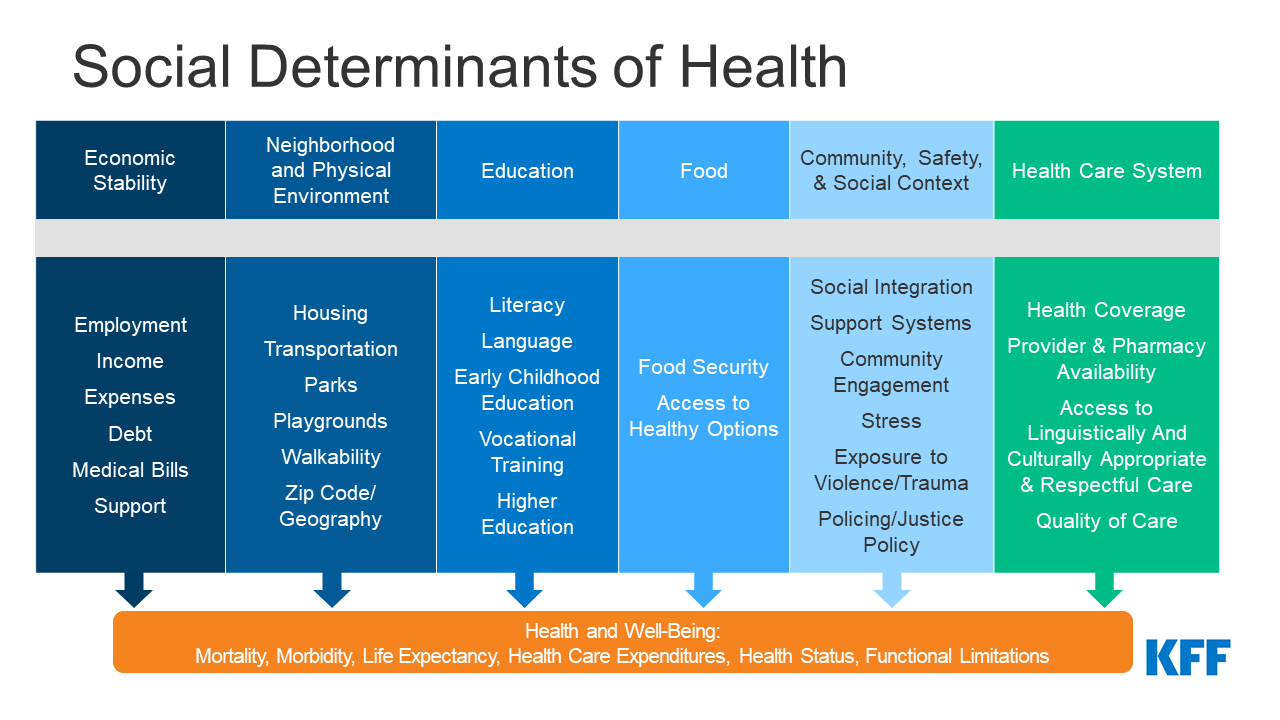

Tracking Social Determinants Of Health During The Covid 19 Pandemic Kff

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Childctc The Child Tax Credit The White House

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit Monthly Payments To Begin Soon The New York Times